Payroll tax withholding calculator 2023

Ad Process Payroll Faster Easier With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself.

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

The standard FUTA tax rate is 6 so your.

. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. This calculator is integrated with a W-4 Form Tax withholding feature. Tax withheld for individuals calculator The Tax withheld for individuals calculator is.

Choose the right calculator There are 3 withholding calculators you can use depending on your situation. Discover ADP Payroll Benefits Insurance Time Talent HR More. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Calculates tax and salary deductions with detailed. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Ad Process Payroll Faster Easier With ADP Payroll.

2023 Paid Family Leave Payroll Deduction Calculator. Then look at your last paychecks tax withholding amount eg. 250 and subtract the refund adjust amount from that.

The Payroll Office is. Ad Compare This Years Top 5 Free Payroll Software. That result is the tax withholding amount.

This calculator is integrated with a W-4 Form Tax withholding feature. This calculator is integrated with a W-4 Form Tax withholding feature. Get Started With ADP Payroll.

In the event of a conflict between the information from the Pay Rate Calculator and. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of. Free Unbiased Reviews Top Picks. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. CNBC reported that a recent congressional proposal. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

Get Started With ADP Payroll. 250 minus 200 50. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The information you give your employer on Form. All Services Backed by Tax Guarantee. Subtract 12900 for Married otherwise.

Feeling good about your numbers. All Services Backed by Tax Guarantee. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

The amount of income tax your employer withholds from your regular pay depends on two things. Multiply taxable gross wages by the number of pay periods per. Prepare and e-File your.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The calculator can help estimate Federal State Medicare and Social Security tax withholdings. It will be updated with.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The amount you earn. For example based on the rates for 2022-2023 a.

The maximum an employee will pay in 2022 is 911400. Start the TAXstimator Then select your IRS Tax Return Filing Status. Contact a Taxpert before during or after you prepare and e-File your Returns.

2022 Federal income tax withholding calculation. The maximum an employee will pay in 2022 is 911400. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. It will confirm the deductions you include on your.

Ad Compare This Years Top 5 Free Payroll Software. In case you got any Tax Questions. Free Unbiased Reviews Top Picks.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Take these steps to fill out your new W-4. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Multiply taxable gross wages by the number of pay periods per. Nanny Tax Payroll Calculator Gtm Payroll Services. 2020 Federal income tax withholding calculation.

3

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

1

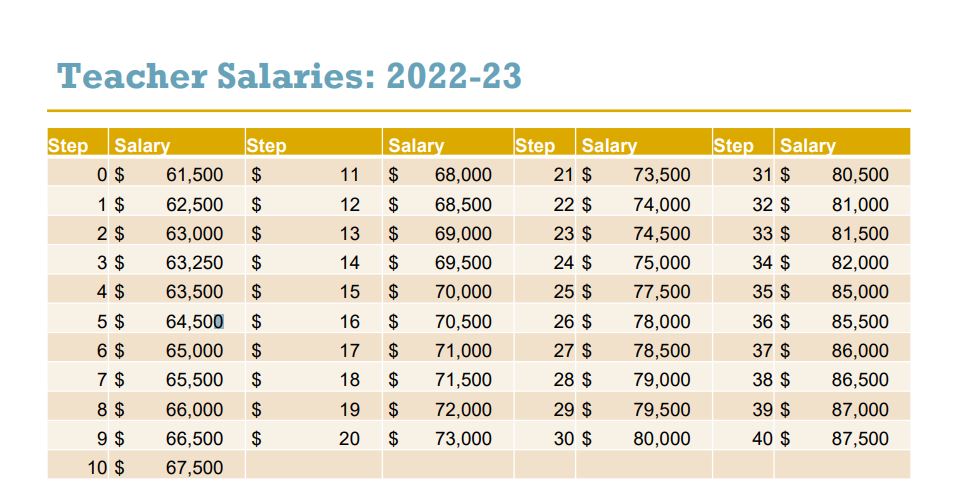

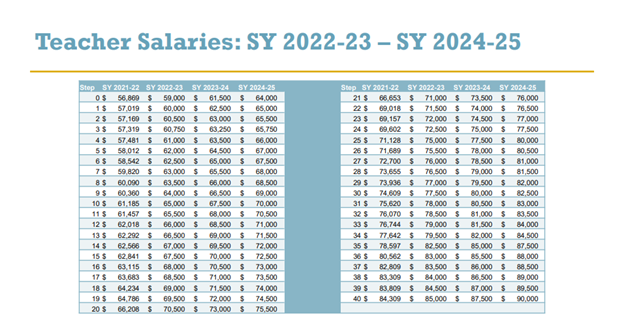

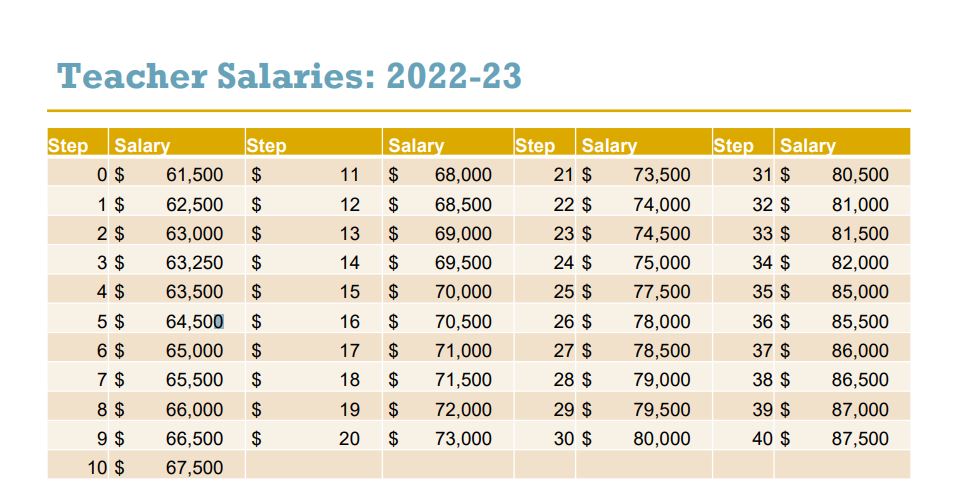

Hisd Announces Teacher Salaries Raises Through 2025 News Blog

Estimated Income Tax Payments For 2022 And 2023 Pay Online

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Calculator And Estimator For 2023 Returns W 4 During 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

1

Social Security What Is The Wage Base For 2023 Gobankingrates

1

Form 941 For 2023

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog